|

|

|

|

|

|

|

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

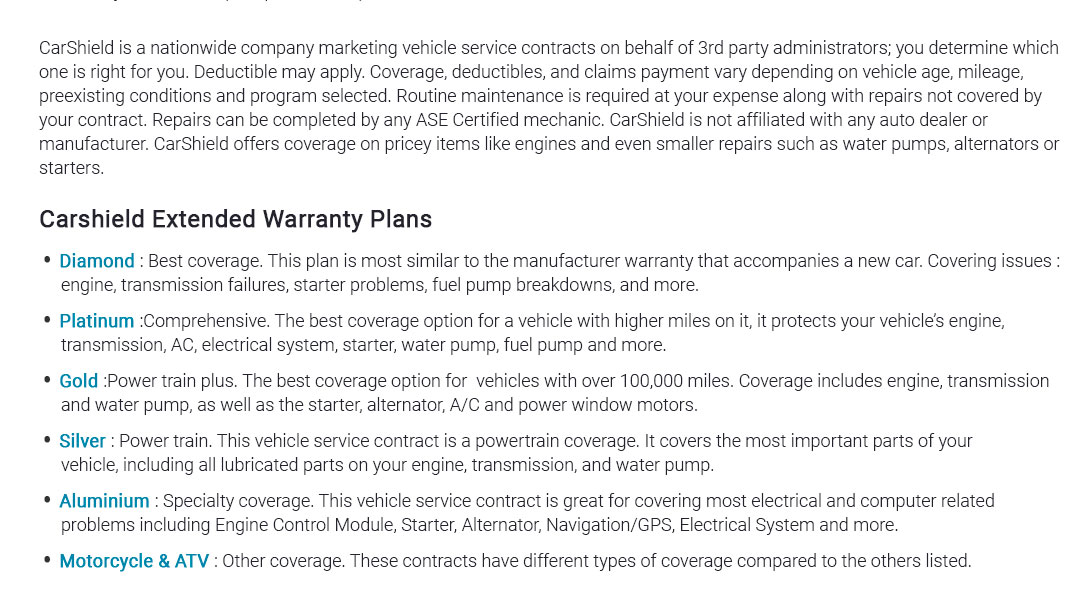

used car warranty companies explained with clear choices and calm expectationsYou want protection from surprise breakdowns, not promises that melt the moment a warning light appears. Here's how to evaluate used car warranty companies with a practical, detail-first lens. What they actually cover - and what they don'tMost plans focus on mechanical and electrical failures due to normal use. Routine maintenance, wear items like brake pads, and cosmetic issues are typically excluded. Pre-existing conditions are almost always out. That sounds strict, but clear boundaries keep costs in check and approvals predictable. Coverage styles at a glance

Where value hidesValue shows up in fast claims handling, fair labor rates, and flexibility with your preferred shop. It's less about the brochure and more about how easily a real repair gets approved. Red flags to watch

Questions to ask before you sign

Real moment: last winter, a customer with a 2015 Accord had a starter fail in a grocery store lot. The shop phoned the provider, sent a quick photo plus the diagnostic code, and received approval within an hour. The driver paid a small deductible and drove home that evening. Not glamorous - just smooth. Cost mechanicsExpect pricing to scale with mileage, vehicle complexity, and term length. A simpler sedan often lands in the mid-hundreds per year; luxury SUVs and turbocharged models trend higher. Simple cost mathIf a three-year plan costs 1,350 with a 100 deductible and your likely risk is a 1,200 alternator plus a 2,100 AC repair over that period, the plan may return value - if both items are covered and approved without unusual exclusions. How to compare without losing your weekend

Tempered expectationsEven top-rated providers can decline gray-area failures. That's not always bad faith; it's policy scope. Aim for predictable help with common failures, not a blanket guarantee against every rattle or squeak. Fine print that moves the needle

Independent mechanics and claims flowMany used car warranty companies will work with any certified shop. The best ones approve reasonable OEM or quality aftermarket parts, pay electronically, and don't force you to tow across town. When to skip a warrantyIf your vehicle has a strong reliability record, low annual mileage, and a healthy emergency fund, self-insuring can be smarter. The goal is risk balance, not coverage for coverage's sake. Quick checklist

Next step, at your paceCollect two to three full contracts, read the exclusions slowly, and sleep on it. A measured choice today beats a rushed one - and that's how warranties provide real value when you actually need them.

|